Welcome to WA Financials

WA Financials is a cash loan service, based in Klerksdorp, specifically focused on meeting the unique financial needs of South African people with friendly service.

With a strong background in the financial sector and a passion for what we do, we can address your financial requirements expertly whilst providing fast and friendly customer service.

We can offer , flexible loans to help you manage your cash flow and eliminate month end stresses.

About Us

WA Financial Services was established in 2002 and has built a personal relationship with our clients over many years. We are always ready to listen and help our clients and understand that life gets difficult at times. We are conveniently located in the middle of town in Klerksdorp, in the North West province of South Africa for easy access to the public. Furthermore, we belong to the NCR and MFSA and proud ourselves on honesty and transparency within the market.

Our Policies:

- Terms and Conditions in Terms of Loans,

- Privacy and Personal Info,

- Dispute Resolution,

- Jurisdiction,

- Language Policy,

- Complaints.

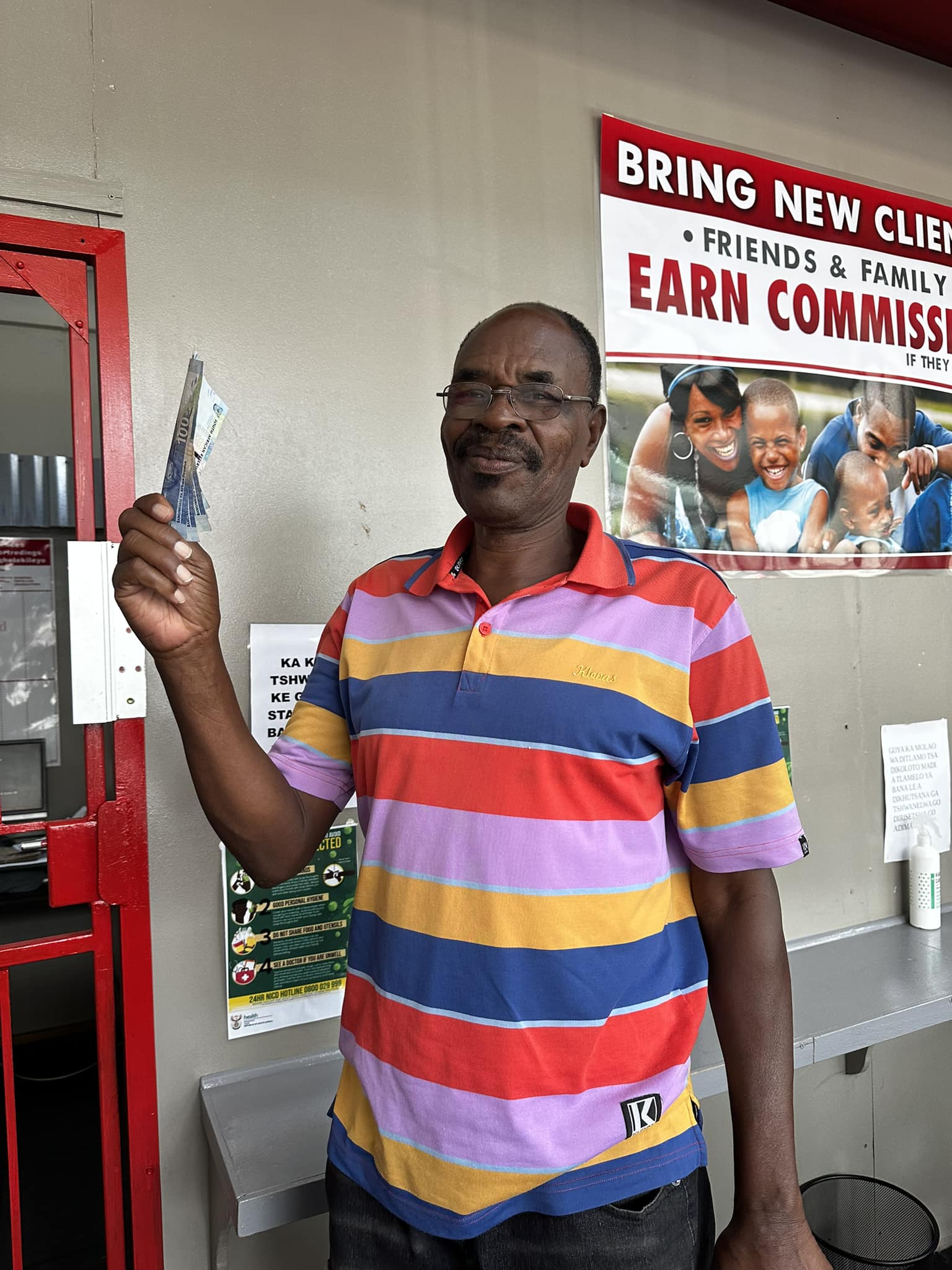

WINNER!!!

We do a lucky draw every month, and you can be one of them!

Our Services / What we offer:

- Should you have emergency expenses to cover, we can offer you a short-term loan that will give you financial breathing space.

- We assist with once-off loans, or short-term loans that you can pay over a selected period.

- We help anyone who is employed, Domestic workers, and SASSA recipients.

HOW IT WORKS:

STEP ONE:

Fill in application form.

STEP TWO:

Submit proof of ID / passport, latest payslip & 3 months’ bank statement.

STEP THREE:

Once the loan is approved, the money will be paid directly to you and might take up to 24h to process.

Simply complete the steps below to get your personal loan approved by the WA Financial Services team.

We will collect a debit order from your specified bank account on the agreed repayment date.

The online loan and all fees, costs and charges are reflected upon application.

What you see, is what you get. No hidden costs.

Frequently Asked Questions:

How is affordability calculated?

Once the payment profile has been assessed, we will then look at your affordability, and if you are able to repay the loan instalment. Your income will be compared to the instalments included on your credit check, as well as all your monthly expenses as set out by the National Credit Regulator..

What are the reasons my loan application can be declined?

● You cannot afford the loan ● You are under debt review ● You are under administration ● You are not permanently employed ● You have been working for less than 6 months at your current employer ● Your documents are fraudulent ● Bad credit history (E.g. late payments, blacklisted, etc.)

What do I do if my banking details change?

Inform us immediately. If your debit order does not go through, your credit record will be affected, and this will affect your ability to apply for future loans and credit.

How much can I borrow?

This will be calculated when we receive all your documentation, an affordability assessment must be done to determine how much you will be able to pay back..

What do I need to apply for a loan?

As outlined in the National Credit Amendment Act of 2015, we require a copy of your ID, 3 months bank statements, proof of address and your latest pay slip to be sent to us to complete the verification process. If you receive a grant from SASSA we need a letter from SASSA and 3 months’ bank statements.

How do I settle my loan?

You can request a settlement quotation by emailing us at wafinancial@lantic.net or by calling us on 018 4627474. Payments can be done via EFT.

What is an initiation fee?

The initiation Fee is a once-off fee. You will pay a fixed fee of R165 and then 10% of the value of your loan above R1000. The fee is capped at 15% of the loan value.

What is a service fee?

In accordance with the National Credit Act, a daily service fee is charged by WA Financial Services, in order for us to manage and service your loan responsibly. This includes reporting the status of your loan account to the NCR, and corresponding with you via email, SMS, and telephone. The service fee is a monthly fixed amount of R60..

What is the settlement value?

The settlement value is the total amount required for you to settle your loan. This includes the loan amount, interest, and all other fees, charges and/or costs payable in terms of your Loan Agreement.

What is the Pre-Agreement Statement and quotation?

This is the documented and contractual summary of your loan. It includes your personal information, our company information, and the terms and conditions required by the National Credit Act. The Pre-Agreement will act as the quotation for your loan, and once you accept the quote, it will serve as a tax invoice.

What is the mandate & debit order authorisation?

This is the documented and contractual summary of your debit order instruction, where you confirm that we can collect your repayment by debit order.

When do you debit my account?

Repayments will be made monthly via direct debit order, on the specified date (the date on which the you receive your remuneration).

Non-Payment

Our collections department will make arrangements to resolve non-payment. However, should we not receive the money in a reasonable period, your account will be handed over to an external collections company. Continued failure to repay a loan will mean that we may be forced to take legal action against you. In addition, the credit bureaux will record the outstanding debt. This information may be provided to other organisations to perform similar checks and recover debts that you owe. Records remain on file for a number of years after they are closed, whether settled by you or not.